what is considered income for child support in colorado

What Is Not Considered Income for Child Support. Other child support orders financial support given to children the parent may have with another partner and any alimony that may be due or received.

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Process

Gross income includes the following.

. Some factors considered in a support calculation include. The amount a salaried employee gets if they do direct deposit. The same holds true regarding income from a trust.

Child support is intended to help support the raising of the children such as paying for their food clothing transportation etc. Tips declared to the IRS or imputed by the court. Colorado calculates child support using the Income Shares Model of support which is based on the gross income of both parents and general information about what intact families spend on their children.

Except when it doesnt means-tested payments are excluded from the definition of income which means Supplemental Security Income SSI does not count. For example if the father earns 40000 per year and the mother earns 60000 per year combined 100000 per year then the father is responsible for 40 of the child support while the mother. In Colorado gross income is what matters for maintenance and child support.

Child support is a percentage roughly 20 for 1 child and an additional 10 for each additional child of the combined gross income of the parents which is then split between both parents depending on other factors. The childs income if any The number of overnights the child spends with each parent. Depending on the state in which the case is taking place income in terms of child support can have a slightly different definition than what we traditionally consider income Depending on the circumstances it is possible for social security benefits retirement benefits loan proceeds and stock option sales proceeds to also be considered income in terms of child support.

Net income is the money left after taxes and deductions. It is related to child betrothal and teenage pregnancy. Basically this means that you are responsible for reporting any money that you receive with the exception of lottery winnings as a source of income when you are being reviewed for a support order.

Child marriage was common throughout history even up until the 1900s in the United States where in 1880 CE in the state of Delaware the age of consent for marriage was 7 years old. If the income generated by the trust your parents set up for you never actually makes it to your. Child support is a court order requiring one spouse to pay the other for a childs basic expenses after a divorce.

Finally this adjustment is an adjustment to income NOT to the child support itself. 14-10-114 and child support CRS. What is considered income for child support in colorado.

The noncustodial parents share of support sets the amount of the order. 14-10-115 includes pretty much all payments a person receives whether taxable or non-taxable. Under Colorado Revised Statutes Section 14-10-115 a parents adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations.

Child support payments are meant to cover certain expenses associated with raising a child. Income can refer to more than just the. I Gross income includes income from any source except as otherwise provided in subparagraph II of this paragraph a and includes but is not limited.

What Is Considered Income. Expenses including health insurance and daycare. The childs income if any Number of overnights the child spends with each parent.

Significant expenses specific to the child such as. As a non-custodial parent the one who cares for the child less than 50 of the time you will be required to pay child support to the other party the custodial parent. It is not a credit which is deducted from the actual maintenance or support owing.

Most divorces involving children end with one parent having to fulfill a child support order until the child turns 19 or older with some exceptions. The starting point for determining the child support payments in Colorado is the pre-tax income of each parent. In the state of Colorado income that can be used for child support is income that is obtained from any source.

Depending on whether you actually received money the court may or may not include capital gains from stock transactions as part of your income that is subject to child support. The broad definition of income for purposes of maintenance CRS. The gross income of both parents.

The Guidelines are long. It is important to understand exactly what the law considers income when determining a child support award. A For the purposes of the child support guidelines and schedule of basic child support obligations specified in this section the gross income of each parent shall be determined according to the following guidelines.

The guidelines use a formula based on what the parents would have spent on the child had they not separated. So if a parent is paying 500mo for the support of a non-joint child the 500 is deducted from the parents income then the resulting support or maintenance is calculated. Child Support For High Income Earners.

Work- or school-related daycare. The table identifies the amount of support owed by parents given every monthly combined income starting at 100 and goes all the way to 30000mo at 50 increments. Gross income before taxes of both parents.

For more information on how child support is calculated see Child Support in Colorado. In determining the amount of support the court shall consider all relevant factors including.

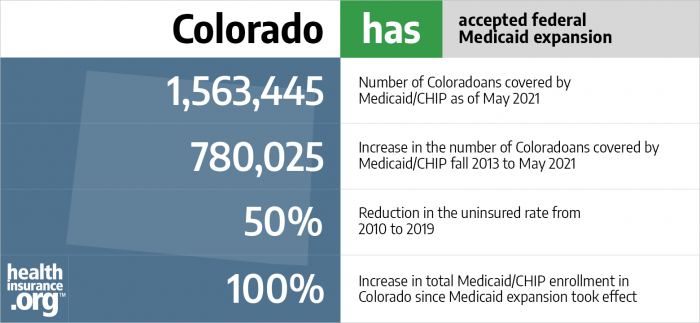

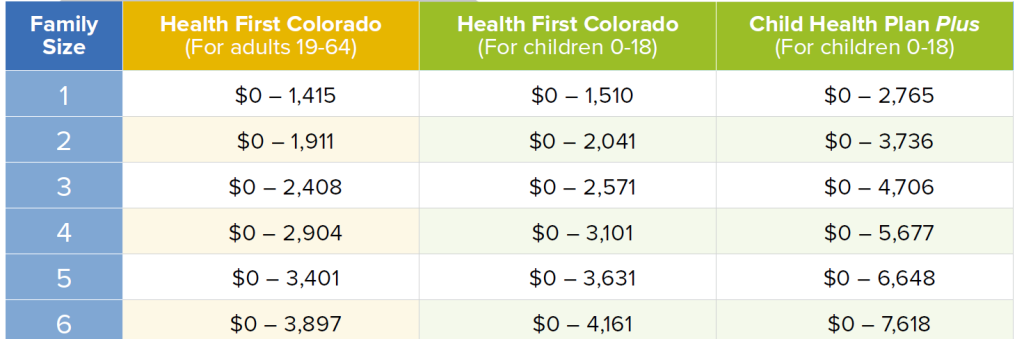

Aca Medicaid Expansion In Colorado Updated 2022 Guide Healthinsurance Org

10 States Where Salaries Are Too Low Being A Landlord Salary Cost Of Living

Everything You Need To Know About Health First Colorado Medicaid

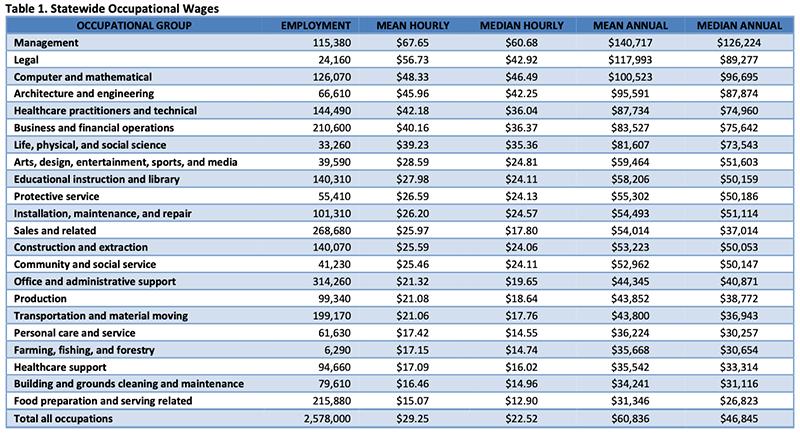

Press Release Colorado Occupational Employment And Wages 2020 Department Of Labor Employment

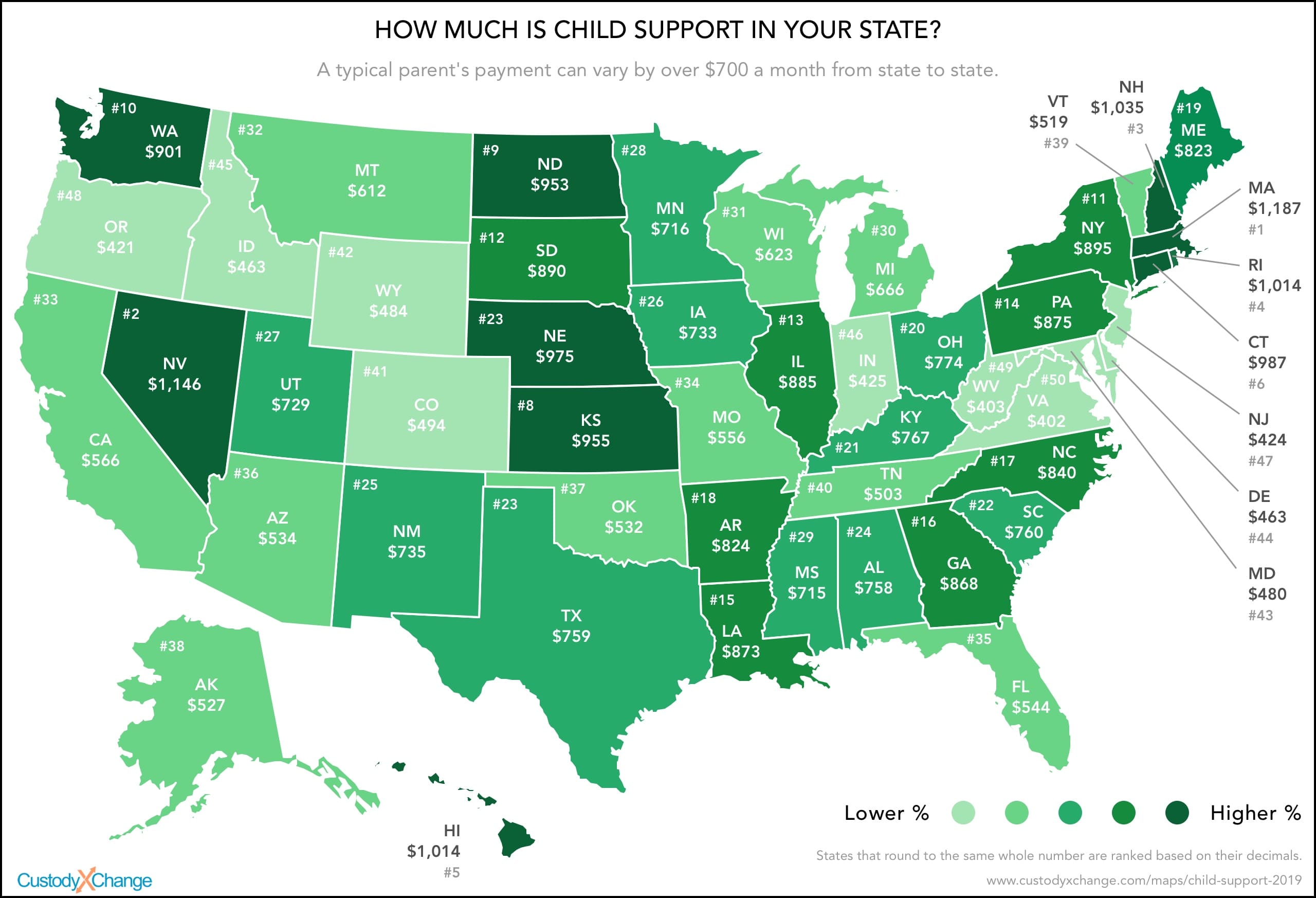

How Much Is Child Support In Your State Custody X Change

Median Income By State Income New Hampshire Illinois

Colorado Cash Back Q A Why Didn T I Get The Full Amount

Voices For Utah Children A Comparative Look At Utah And Colorado Economic Opportunity School Readiness Utah Kids Education

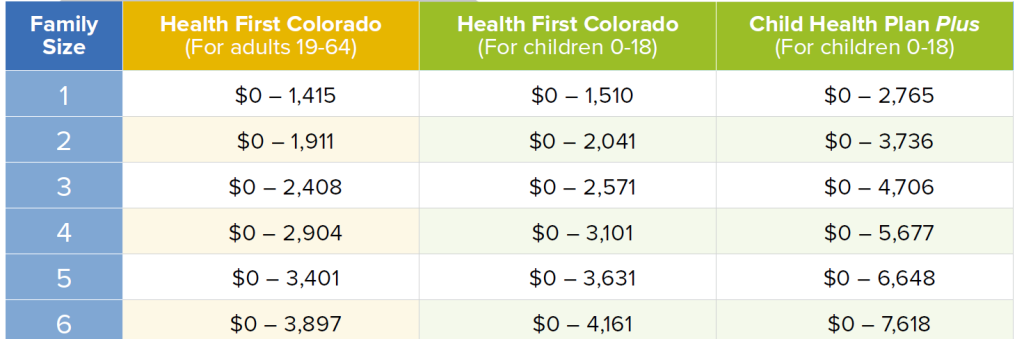

Are You Eligible For A Subsidy

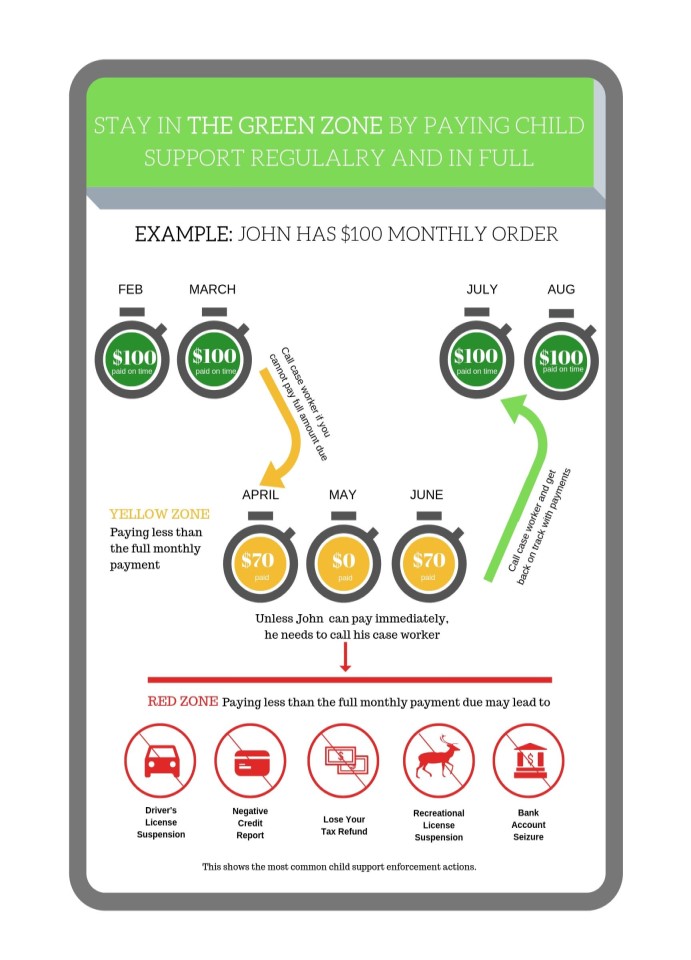

Enforcing Orders Colorado Child Support Services

Women Infants Children Wic Mesa County Public Health

Child Support Basic Obligation Colorado Family Law Guide

Frequently Asked Questions Colorado Child Support Services

New Vernon Washington Township Harding Long Valley Morris County New Jersey Divorce Child Support Mediator Child Support Laws Supportive Divorce And Kids